Content:

Johann König, the world-renowned German gallery owner describes the current change in the art market so "The market is becoming gigantic! The art market is turning from an elite sport into a popular sport." Current figures from the art market prove him right. The days when the art world and was open only to a certain elite are long gone; according to Art Basel and UBS Global Art Market Report, the Millennial generation alone represents by far the fastest growing segment among art collectors.

Buy art online or on site?

Online auctions are one of the fastest growing areas in the auction business, and the corona pandemic has accelerated this trend even further. Around 15 percent of German Internet users have have already bought goods at auction on the web. on Well-known online platforms how Lottissimo, Invaluable, or directly from the auction houses themselves, art lovers worldwide can bid at works in all epochs, genres, styles and price segments. So auction houses were able to post record sales despite sometimes empty auction rooms.

The hall auction as an event

Does this mean the end of hall auctions? Probably rather not, also if the trend is to be stopped according to opinion of many experts not , a hall auction is a singular and exciting Event, particularly then if it to exciting Bietergefechten in the hall even comes and one bid the next hunts, this tension which one can feel in the hall literally, an on-line auction not will be able to replace.

for Whatever you decide, whether online or on site, art is now easier than ever to bid for. As an auction house, however, we still recommend that you take part in a room auction, whether as a bidder or simply as a spectator, it is and remains a unique event.

Are you an art lover, investor or both?

Clearly, if you art buy, you should also have a certain know-how and an affection for the art world have. it is important to understand why a artist appropriate prices and how the artist has developed in recent years. Above all: how it could develop! Often the combination of individual taste, financial possibilities, set priorities and personal affinity is then for the purchase decisive.

Of course, it primarily art is about moments of art historical triad between object, artist and viewer. Accordingly, it is always advised to buy art that you like and .

You can imagine the art market in principle, how a microcosm of networked curators, experts, galleries, critics and auction houses that you can enter as a customer.

Pia Maria Lukas-Larsen - Art Historian M.A

Art investments go beyond the simple flirtation and vague presumption of the price increase of a particular work. Because here we speak just as of a decision for a work of art, how of investment portfolio, inflation protection and assets for companies and private investors!

Art can mitigate the risk of your portfolio by spreading your assets on across different investments. It is important to note that that art not correlates with other assets on the stock market. For example, stocks are much more sensitive than physical assets. Art is subject not to geopolitical conditions or inflation. Works of art that last for years and decades may well store assets as a capital investment. So art serves as an effective hedge - in line with the buy-and-hold strategy.

Why invest in art?

Well, on the one hand, it is certainly due to the reputation that one receives through compositionally outstanding art. If one considers for example the Vedutenmalerei, which was brought along already around 1700/1800 as a kind Souvenir particularly from Italy and the houses of the well-heeled and scholars decorated have, was it thereby also always around it to show where one traveled, which one experienced there and which one can afford.

Prestige is to be attached at this point probably just as, how a certain "emotional yield", which brings the art with itself. Because if you buy art, you will certainly enjoy it have to live with it! In the end, the reasons why one invests in art so are diverse how the art market itself.

What makes the art market?

Supply and Demand is the core of every market - the soul of trade, so to speak. Basically, the art market is formed by primary market and secondary market. These two sub-sectors make up the global art market, which was estimated to total $50 billion in 2020 on .

The primary market is formed mainly by artists who are masters of self-promotion or galleries that represent artist . Here artworks for are offered for the first time for sale in the distribution. In the secondary market works are resold, to this counts for example also our auction house but also galleries are active in the secondary market.

Within these two major subdivisions, however, it again subdivisions into different departments: Old Art, contemporary art, modern art, photography, decorative arts and many other divisions that require their own experts . Understandably, if one considers, that you as a buyer works of the entire history of art can be offered.

You can imagine the art market in principle, how a microcosm of networked curators, experts, galleries, critics and auction houses that you can enter as a customer.

What should you consider before buying art?

Consider your budget in relation to your total assets and check the status of the artist. The forecast of the possible increase in value arises from different data, how already held auctions, exhibitions of the artist and presence on the art market.

The movement in the art market happens from purchase and resale of works. So describes for example Werner Schmalenbach in its book "the desire on the picture" the structure of the art collection NRW. Here just how in all collections art was bought and in the course of the rearrangement of a collection again sold. So one separates from works and adds again others. A profit can also be made in the process.

However, you can achieve the profit of a resale not "overnight". Art investments are for suitable for patient investors who can also wait a few years between purchase and sale. The current market value is measured, how already mentioned, by the notoriety of the artist, already achieved prices and presence. it there artist, which enter the collective perception of our cultural landscape through art experts, critics, collectors and exhibition houses.

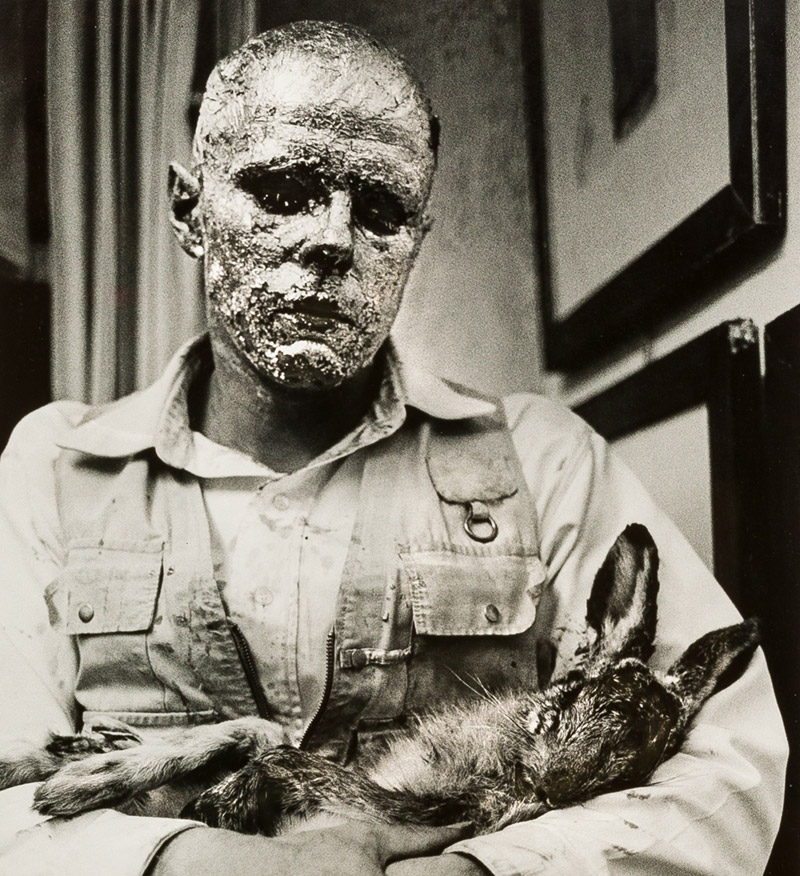

it there are also many artist, who understand the "art of self-promotion" and even become a "brand" themselves, well-known representatives include Andy Warhol , Joseph Beuys and Jonathan Meese.

It should also be considered, for example, that that a young artist probably still has a few creative years ahead of her in which she can develop. So perhaps it is worth buying an early work? Nevertheless, an older established artist can make out a successful and profitable resale in 10 years, because it is probably certain, that his works will tend to decrease with time - a shortage will arise, which will drive the price increase. Especially since it is certain that that no new works will be offered after his death.

In the art market, one or the other aspect is simply different than on other markets. So a artist will produce less and less as his career rises, because he deals more critically with his work and his works thus become "signature pieces" that are very rare. In industry, on the other hand, an object that is good sell would be produced thousands or millions of times and probably sold worldwide to ensure sales. But it is precisely this scarce supply that drives the price in the art market.

Does it provide a guarantee or risk of loss?

Basically it has to be said at this point: every market holds risks, so also the art market. it is almost impossible to determine the exact resale amount of a work of art in advance. Because it not is sufficient only to know the market value, but it must for a work of art also first a new buyer be found.

But please keep in mind, whether it it's a painting by an artist you have a lot of hope in have or a diamond ring from your grandmother, often have works an "Emotional Value" and an actual market value that can vary significantly.

it is a great advantage, if art is a pleasure for you! Because, so have you despite risk something from it: A work of art! Most art investors start as collectors who piece for piece develop a sense for the art market and then specialize on sub-areas.

Why it is worth investing in art!

In summary, that it is always worth investing in art, but here again are the 10 most important points to keep in mind it :

- You should have a strong interest in the art world, its players and works have - specialize in this preferably on a sub-area of art.

- You should inform yourself before a purchase how the current state of your selected artist is and how the object, which you intend to buy , is to be located in the oeuvre of the artist. What else can be expected from the artist ?

- Consider whether the object fits into your own collection.

- Find a suitable provider of the appropriate artist and select your object , in galleries or auction houses, whether online or classic on site, here have you many options. However, be sure to stick to reputable houses - a good provenance helps just as resale!

- In doing so, be sure to scale a budget in advance according to your total assets and stick to it when buying.

- Enjoy your object and have enjoy it! Pay attention yourself on your "emotional return" and your human capital, which is most certainly enriched by the art in your life!

- Even years after the purchase, always find out about the state of the artist. Were it perhaps exhibitions? how is his presence in the art world to assess?

- Keep an eye on on the current market value from time to time to find a suitable time for for resale.

- Should you wish to part with a object , contact an established institution and to have your object appraised again and its value.

- Deliver your object in an equally established house, so you increase the chance on a resale enormously, because where art is searched, it is also found. Collectors, dealers and art interested have usually subscribed to the newsletter and catalogs of auction houses.

More information

Gladly advise You our experts if want to know more about art as an investment. We also recommend you to exchange with other art lovers on fairs, exhibitions, vernissages and art events, this will help you to develop a feeling for the art market!

- Free Consultation and Valuation of your art objects

- The Art Market 2022 - Presented by Art Basel and UBS